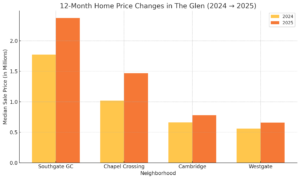

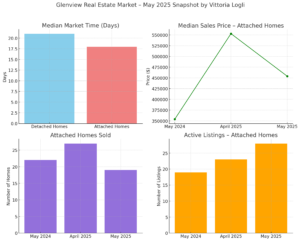

Glenview Il May 2025 Housing Market Update

What’s REALLY Happening in Glenview’s Housing Market?May 2025 Market Update https://youtu.be/MC32YNG4FfA Glenview real estate is on the move. If you’ve been wondering what’s happening with home prices, buyer demand, and how quickly homes are selling, the numbers from May 2025 paint a clear picture — and it’s one that buyers